Money market funds are all the rage right now. The tenacity with which the Federal Reserve has increased the federal fund rates has driven up the yields on treasury bonds, notes and bills.

For the last 20 years we haven’t gotten anything from the banks, depositors are sick of the minuscule return on their savings accounts. As a 33-year-old millennial, I’ve never thought much about fixed income, and for the first time in my investing life, the yields are attractive.

Mix in the regional bank turmoil of Silicon Valley Bank and First Republic and we get a bonfire getting gasoline dumped on it.

Understanding What a Money Market Fund Is

While this certainly helps explain the money market fund fervor, it’s important to make sure we define what a money market fund is.

A money market fund is a type of mutual fund that invests in short-term, low-risk securities, such as government bonds, certificates of deposit (CD’s), and commercial paper. These funds aim to provide investors with a low-risk, low-return investment option that can be easily accessed and quickly liquidated.

Just as Safe as Cash

Money market funds are often regarded as investments with very low risk on the spectrum; although they are not entirely as secure as cash, it’s pretty close.

That being said, it’s important to remember that no investment is entirely risk-free. While money market funds are considered to be relatively safe, there’s still a chance that an investor could lose money if the fund’s underlying securities experience a significant downturn.

Some money market funds may also charge fees or have other expenses that can eat into an investor’s returns.

What’s the Difference Between Money Market Funds and Mutual Funds?

Mutual funds and money market funds are both types of investment vehicles, but they differ in a few key ways.

A mutual fund is a type of investment vehicle that pools money from many investors to invest in a diversified portfolio of stocks, bonds, or other assets. When you invest in a mutual fund, you buy shares in the fund, and the value of those shares goes up or down depending on the performance of the underlying investments.

Money market funds, on the other hand, invest in short-term, low-risk debt securities like Treasury bills and commercial paper. They are designed to provide a safe and stable place to park cash while earning a slightly higher return than a savings account. Money market funds aim to maintain a stable net asset value (NAV) of $1 per share, and their returns are typically lower than those of mutual funds.

Here are some key differences between mutual funds and money market funds:

- Investment objective: Mutual funds seek capital appreciation over the long term, while money market funds aim to preserve capital and provide a stable return.

- Risk: Mutual funds can be more volatile than money market funds because they invest in a wider range of assets. Money market funds are designed to be low-risk investments.

- Returns: Mutual funds typically offer higher returns than money market funds over the long term, but money market funds are more suitable for short-term cash management.

- Liquidity: Mutual and money market funds offer daily liquidity, meaning you can buy and sell shares on any business day. However, money market funds are generally more liquid than mutual funds because they invest in highly liquid securities.

Money Market Fund Flows 2023

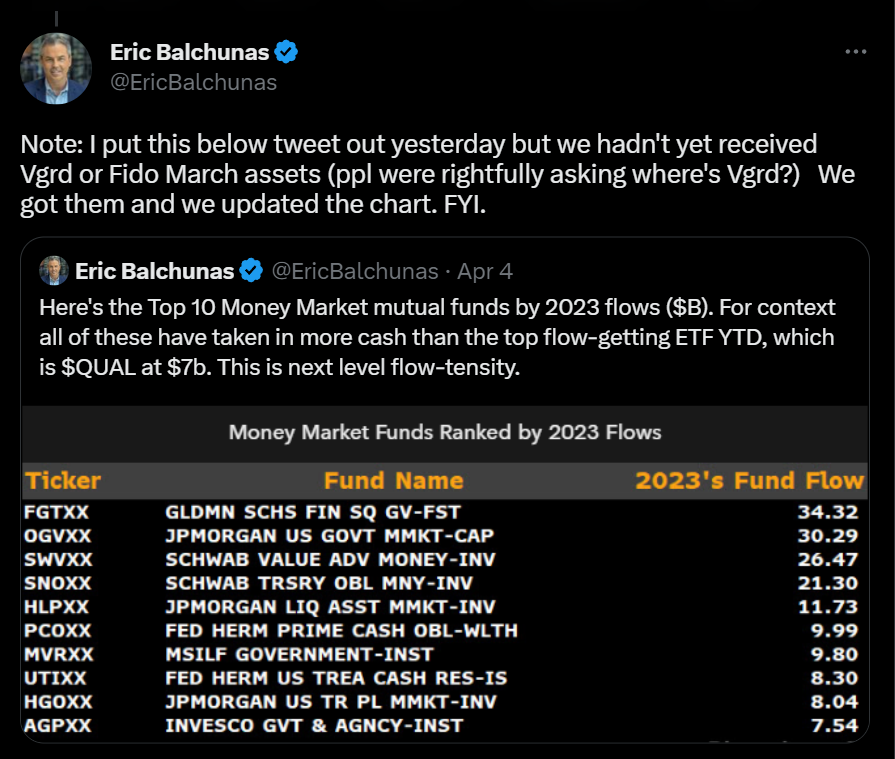

A tweet from Senior EFT Analyst for Bloomberg, Eric Balchunas shows the huge flows this year that are moving into these funds.

Will these Flows Lead to a Bubble?

The sharp increase and move has led many people to ask whether or not a bubble could be forming in Money Market Funds. There was an article about this a little over a week ago in Barron’s by Jacob Sonenshine that discusses this. He has an interesting take, the article is a little “clickbaity” but interesting nonetheless. I don’t think there’s a bubble because of how Money Market Funds are structured, but Silicon Valley Bank was also a solvent financial institution before this past March, so at the end of the day, who knows, although I find it incredibly unlikely.

References:

Investopedia. (2023, March 14). Money Market Funds: What They Are, How They Work, Pros and Cons. Retrieved April 7, 2023, from: https://www.investopedia.com/terms/m/money-marketfund.asp

Fidelity Investments. (2013, November 5) What are money market funds?. Retrieved April 7, 2023, from: https://www.fidelity.com/learning-center/investment-products/mutual-funds/what-are-money-market-funds

Investor.gov. (2023, March 28) Money Market Fund. Retrieved April 7, 2023, from: https://www.investor.gov/introduction-investing/investing-basics/glossary/money-market-fund

BuySide from The Wall Street Journal. (2023, April 4) What Is a Money Market Fund? Retrieved April 7, 2023, from: https://www.wsj.com/buyside/personal-finance/what-is-money-a-market-fund-d467f92f

Barron’s. (2023, March 31) The Newest ‘Bubble’ Is in Money-Market Funds. Retrieved April 10, 2023, from: https://www.barrons.com/articles/money-market-funds-aum-bank-deposits-a86f932c

Twitter post by: Eric Balchunas, via Twitter

Hey Michael,

I share your enthusiasm for money market funds. Being a fellow midwesterner and having some expertise in finance, I’ve been suggesting them to my loved ones who are tired of earning meager interest rates on their savings accounts.

I believe it’s important to point out the low-risk and ease-of-access nature of money market funds. The investments made make them a safe choice for investors. Moreover, they’re designed to be easily converted into cash if you need quick access to your capital.

Although there have been concerns about a possible bubble forming in money market funds, As you mentioned, the structure of these funds makes it really unlikely. Agreed that recent events like Silicon Valley Bank serve as a reminder that unexpected things can always happen, I still think that money market funds remain a great choice for anyone seeking a low-risk and easily accessible investment who don’t want to just sit in cash and let inflation eat away at their money.

Your knowledge and expertise on various topics never ceases to amaze me I always learn something new with each post.

Your blog is a true hidden gem on the internet. Your thoughtful analysis and in-depth commentary set you apart from the crowd. Keep up the excellent work!